Boyd Gaming Considering Penn Entertainment Acquisition

Boyd Gaming, a gambling operator based in Las Vegas, has reportedly initiated talks with rival Penn Entertainment regarding a possible acquisition.

Boyd is the owner and operator of 28 land-based gambling establishments, such as casinos in Las Vegas and various states, as well as racinos and non-casino properties. Additionally, Boyd is involved in the real money online casino industry and holds a 5% ownership in FanDuel, a major player in sports betting.

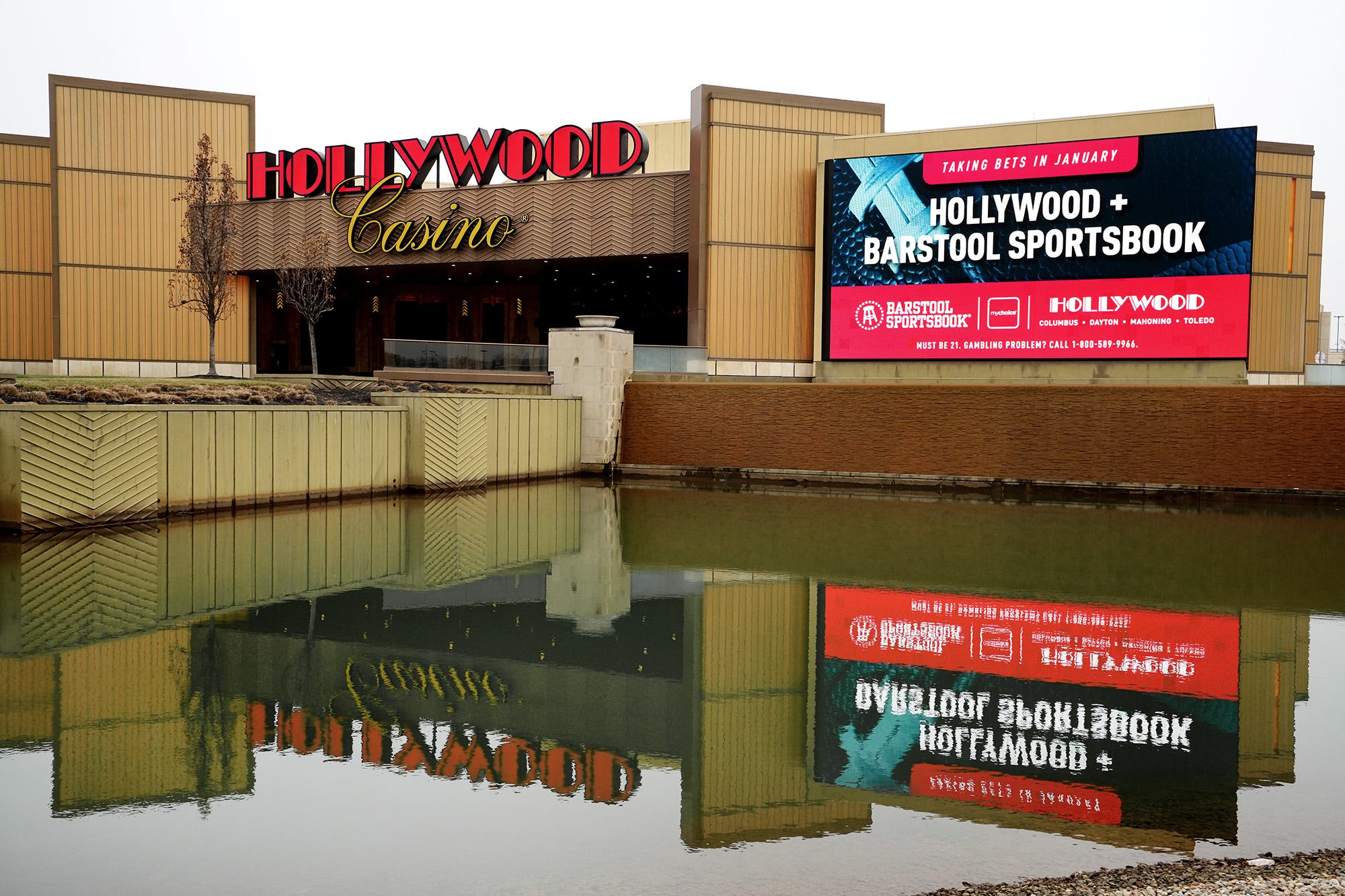

Penn Entertainment, the owner and operator of more than 40 properties across 20 states in the United States, is best known for its renowned Hollywood Casino brand. Additionally, Penn operates ESPN BET, a rapidly growing and top-rated sports betting site, in partnership with ESPN, a subsidiary of Disney. This 10-year partnership is valued at $1.5 billion.

Could Boyd Gaming acquire Penn Entertainment?

The main challenge in acquiring Penn Entertainment and Boyd Gaming is their respective valuations of $9 billion and $7.8 billion. Given their existing debt structures, Boyd will require significant financial leverage to successfully finalize the deal.

Furthermore, the acquisition would require approval from the Disney Company, a stakeholder in the ESPN BET partnership. Additionally, the proposed purchase may face regulatory obstacles in the legal sports betting states where both companies are active.

Sources in close proximity to Penn Entertainment have indicated that the company is not committed to engaging in discussions with Boyd Gaming.

A Truist Securities analyst stated that they do not anticipate Penn conducting a formal strategic review in the near future, citing a clear ESPN Bet product roadmap, the upcoming football season, and the current impact of higher/volatile interest rates on overall M&A activity.

The decision was made in response to concerns raised by Penn Entertainment shareholders about the company’s growth strategy, as well as dissatisfaction expressed by the board’s re-election and compensation packages earlier this month.